We’ve all sent an invoice and then waited longer than we should. You expect payment, but your client is busy, and it slips down their list.

That’s why how you ask and when you ask make all the difference.

In this guide, we’ll show you how to request payment from a client, the right times to follow up, and how to write a polite and professional request that gets you paid without harming the relationship.

How to Request Payment from Client (When and How to Approach)

Requesting payment from clients has a few important parts. You have to consider –

- When to ask for the payment

- The right approach to writing emails

- Asking by email, messages, and over the phone

We’ll break down each element to help you craft the right email, and you will know when it’s the time to send it.

When to Ask for Payment from the Client

Send two reminder emails for client billing before the due date.

For most cases, it should be enough. If not, send two emails after the due date. We’ll guide you on how to craft those emails and what you need to consider.

When you follow up at the right time, there will be less awkwardness for both ends. Here’s when you should send payment reminders –

First Invoice

Once you’re done with deliverables, immediately send an email mentioning that the project is done. Include the invoice number, due date, a clear breakdown of costs, and payment instructions with this first email.

If you don’t use any invoicing tools, Agency Handy can help you create professional invoices. You can then email the invoice to the client.

Payment Email Template: First Invoice Email – When You Deliver the Project

- Let the client know about the due date

- Give the necessary information to proceed with the payment

| Subject: Invoice #123 for (Project Name) Dear Smith, Your feedback made the final deliverable much better. It was a pleasure working with you. Looking forward to working with you again.I’m attaching the invoice #123 with this email. The total bill for my services is $$$. You can pay it via PayPal or direct transfer to my bank account (A/C No). The due date is 30th August. Feel free to ask if you need any clarification. Best regards, John |

If the client prefers WhatsApp for communication, it is better to request payment from the client via a message rather than an email. As you have just delivered the project, you can delay sending an official email for a day or two.

This message would be like –

“Hello David. I have sent all deliverables regarding the recent project via email. This is just to notify you. I will email you an invoice with due details within a day or two.”

Before or on the Due Date

Email a simple invoice letter 1 day before the due date. You can also send this follow-up email reminder on the due date.

Here’s how to write an invoice email –

Payment Email Template: Friendly Reminder – on the Due Date or a Day Before

- Reminder

- Short and direct approach

- Polite and professional

| Subject: Friendly reminder about payment for invoice #123 (Due Date) Dear Smith, Hope you’re doing fine. This is to remind you that Invoice #123 is due today/tomorrow. You can pay via PayPal or direct bank transfer to the bank account (A/C No). Feel free to reach out if you have any questions or need assistance. Best regards, John |

When the Invoice is Overdue

If the client still doesn’t send you the payment 1 week after the due date, there shouldn’t be any reminder. This time, you need to clear your payment terms and time frame discussed earlier.

But knowing how to ask for payment professionally is the key here. It might be that the client is too busy and forgot about the email you sent earlier. Or the client will send you the due payment within a week.

If you send an aggressive email, the situation can get out of hand.

Payment Email Template: One Week to Two Weeks Overdue Email

- Direct

- Politely ask to make the payment

- Mention late payment fees (if any)

| Subject: Payment for Invoice #123 One/Two weeks overdue Dear Smith, This email is to remind you again about the overdue payment for invoice #123. It’s one week overdue. Maybe you forgot or are having a busy time. I wanted to remind you about the late payment fee which we agreed upon. If you have any further queries, please let me know. Send the payment as soon as possible. I’m attaching another copy of the invoice with this email. If you receive this email, please reply to this email and let me know. Thank you. Best regards, John |

When the Payment is 30-day Overdue

Things start to get a bit messy when it’s 30 days overdue. By this time, you should think about what steps can be taken. If any contract paper was signed, you can take legal action. But, send an email similar to this one –

Payment Email Template: A Month Overdue

- Firm and concise

- Politely ask to reply and complete the payment

| Subject: Payment for Invoice #123 is overdue (30 Days) Dear Smith, This email is to remind you that the invoice #123 is overdue for 30 days. There will be a late payment fee starting from tomorrow $50/day.If you have any questions let me know. Please make the payment immediately by PayPal or direct bank transfer to the account (A/C No). I’m sending you another copy of the invoice with this email. Looking forward to getting a reply to this email. Thank you. Best regards, John |

Important Read: How to Make a Company Invoice

How to Ask for Payment Politely

The way you ask for an invoice to be paid matters just as much as the timing. Perhaps the client is experiencing a temporary issue and will just need a bit more time.

If this client has the intention to work with you in the future, then, out of frustration, you should behave in a manner that would make him end the contract.

So, being professional yet polite is the key here. And you need to be persistent as well, without being aggressive.

- Professional: Start the email or your medium of communication in a respectful manner. This reduces the tension. Clearly mention the invoice number, due amount, and date.

- Polite: Don’t sound as if you’re accusing the client. If the client is experiencing difficulties, acknowledge their situation and offer a solution. You may ask the client to send you the partial payment for now.

- Persistent: Regardless of how many times you have to remind the client, approach calmly. The agenda is to ask him to pay you professionally.

How to Ask for Payment by Email

Most freelancers prefer using email to communicate formally with their clients. They use it for asking for payments as well. Here’s what you need to consider when you write an email payment reminder –

Make sure –

- You’re contacting the right person responsible for financial affairs

- Invoice number is correct

- Total due amount is right

- Project details are clearly mentioned

What to Include in Your Email

A well-structured email increases the chances of getting a prompt response. Here’s what every payment request email should include:

- Relevant Subject Line: Use a subject line that is polite yet attention-grabbing. Examples include “Friendly Reminder: Invoice #789 Due” or “Payment Request: Invoice #123.” Your client will immediately understand why you sent him this email.

- Invoice Details: Clearly state the invoice number, amount due, and due date. This makes it easier for the client to identify the payment. For example, “The total amount due for Invoice #123 is $1,500, with a due date of January 10th.”

- Payment Instructions: Provide simple and clear payment instructions, such as a direct payment link, your bank account details, or the accepted payment methods.

- Polite Tone: Always maintain a professional tone, even if the payment is overdue. Don’t make it sound like you’re frustrated.

Automate Sending Emails about Payment

There are invoicing and client management software for freelancers that can automate the email sending schedule as per your input.

Agency Handy, for example, whenever you complete the project, it sends an email including an invoice. You can further send custom reminders to clients. You can further customize it with your payment details.

If you work with a number of clients, sending emails one by one can be time-consuming. Agency Handy can automate sending reminders for you. Just at $19/mo, you can organize clients and projects professionally.

Mistakes to Avoid in Payment Emails

If the client isn’t a fraud, your due or overdue invoices have a high chance of getting paid if you avoid the following mistakes –

- Don’t Ask to Pay Before Due Date: When you’re done with the project, leave a friendly email stating that the project is done, and here are your payment details. That’s it. Don’t mention anything to make the payment before it’s due.

- Overdue Reminder More than One Week: Once the invoice is overdue, make sure you send a friendly reminder within a week. Then you can follow up on the email next week.

- Aggressive Tone: Using a rude or demanding tone can harm your relationship with the client. Always stay polite. Otherwise, even if they pay you now, they won’t continue doing projects in the future.

- Confusing Instructions: Give simple and easy payment instructions. For example, provide direct payment links or specific bank details.

- Failure to Follow Up: If the client doesn’t respond to your first email, send follow-up reminders. Consistency is key to getting results.

Asking for Payment Over the Phone

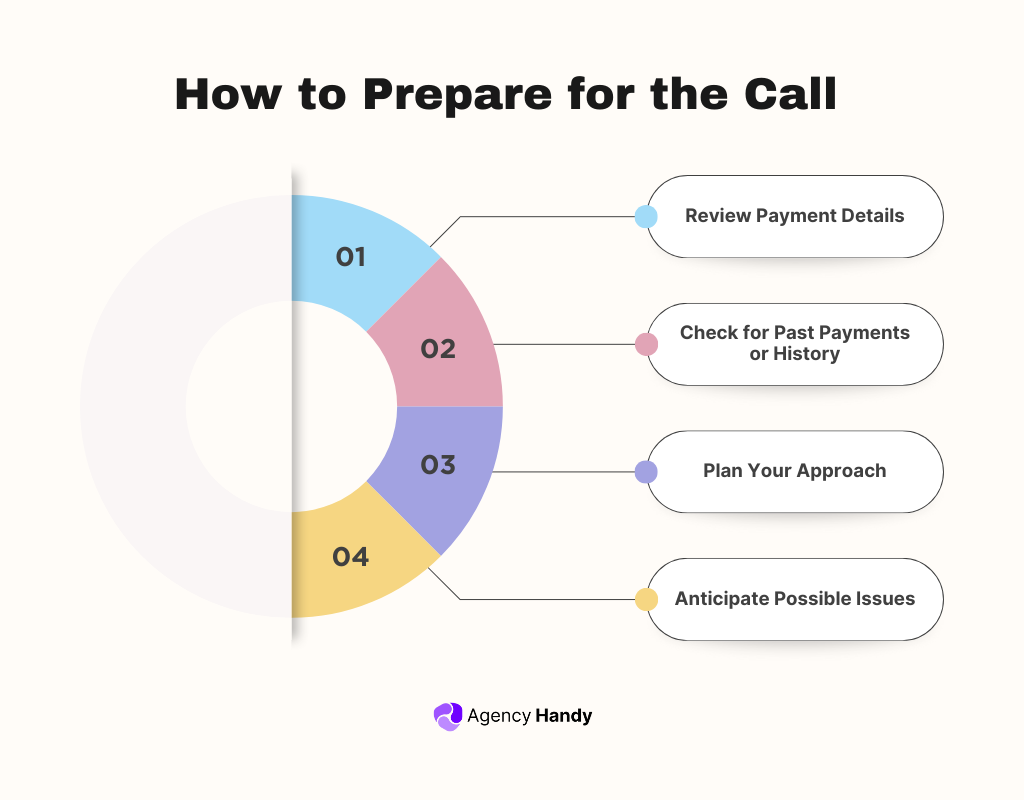

You might have to opt for an over-the-phone approach when emailing fails. This is a more direct way of asking for the payment. So you need some preparations before making the call.

But make sure you’re making a call if several emails about the payment were ignored by the client. Then you will have a solid ground to make a call and can bring up the issue naturally.

Before you make the call, there are a few considerations –

- Make sure you call the right person responsible for the payment

- Introduce yourself along with your project details

- Keep calm and speak clearly

- Don’t let your frustration reflect how you speak

What to Say During the Call Asking for Payment

The conversation should be more like this –

“Hi Smith, this is John, I worked on (name project) a few weeks ago. I handed over the project on (mention date), and sent you several emails about the payment (mention invoice number). You’ve probably missed them. Is that the case?”

This will lay down the foundation to proceed with the conversation further.

Of course, before you make the call, have all the information gathered, and better write it down on a piece of paper or have the invoice opened on the screen. Highlight the following –

Due amount

Project handover date

Invoice number

Due date

If the client responds positively, confirm when they plan to make the payment and thank them for their cooperation. If they raise concerns, listen patiently and address their issues professionally.

What to Do If the Payment is Overdue

When payments are overdue, take action promptly and professionally.

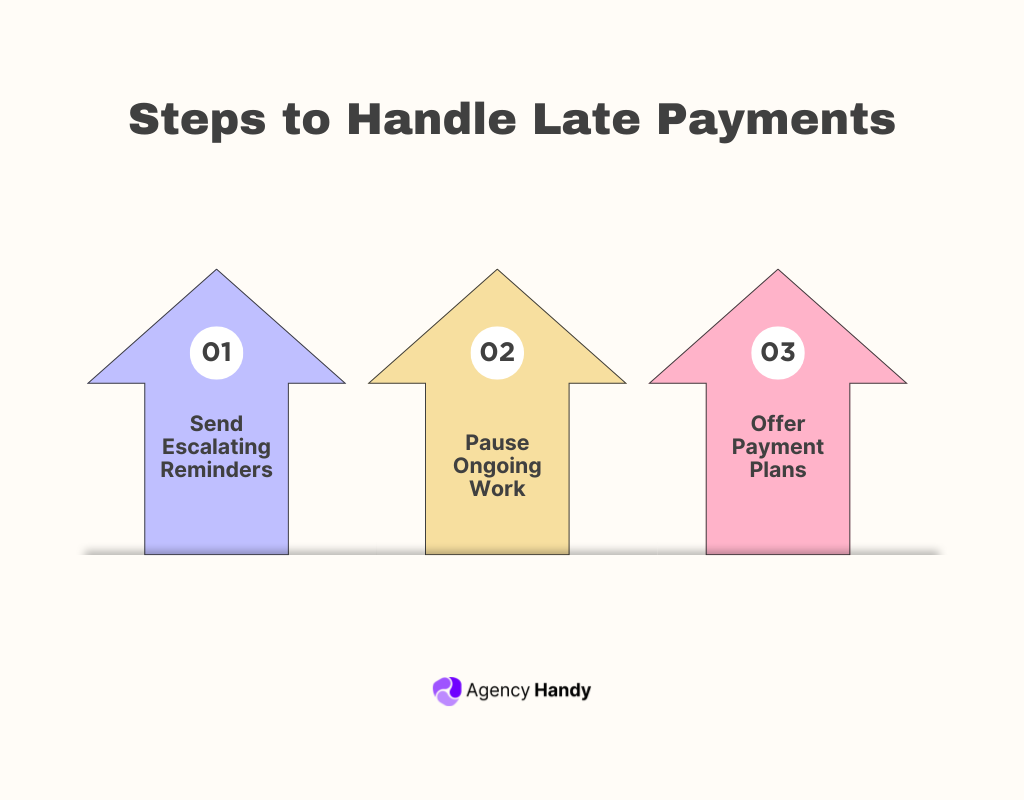

Steps to Handle Late Payments

Overdue payments require consistent follow-ups and escalation if necessary. Here’s how to proceed:

- Send Escalating Reminders

Start with a polite follow-up email a few days after the due date. Gradually make your reminders firmer while maintaining professionalism.

For instance, your second reminder can mention potential late fees, while the third can highlight the importance of clearing the dues promptly.

- Pause Ongoing Work

If the client continues to delay payment, politely inform them that work will be paused until payment is received. For example, “We value our relationship but must pause the project until the outstanding payment for Invoice #123 is cleared.”

- Offer Payment Plans

If the client is genuinely struggling to pay, consider offering an installment plan. Breaking the payment into smaller amounts can make it more manageable for them while showing your flexibility.

Advanced Options for Overdue Payments

If basic reminders and follow-ups don’t work, it may be time to consider more advanced options:

- Hire a Collection Agency: For large overdue amounts, engaging a collection agency can be an effective solution. These agencies specialize in recovering debts while keeping the process professional.

- Legal Action: As a last resort, consider taking legal action through small claims court. Ensure all your records, such as contracts, invoices, and communications, are organized to support your case.

- Send a Formal Demand Letter: A demand letter, drafted by a lawyer, adds legal weight to your payment request. It’s often enough to prompt clients to settle their dues quickly.

How to Avoid Late Payments in the Future

Preventing late payments is better than chasing them. Here are some strategies:

Set Clear Payment Terms

Establishing clear payment terms upfront ensures that clients understand their obligations. Include details about payment deadlines, late fees, and accepted methods in your contracts. Discuss these terms during onboarding to eliminate confusion later.

Use Tools to Automate Payments

Automation simplifies invoicing and payment tracking. These tools can send reminders, generate invoices, and provide easy payment options for clients. This reduces manual follow-up and ensures timely reminders.

Encourage Early Payments

Offering small discounts for early payments motivates clients to prioritize your invoice. For instance, a 2-5% discount for payments made within 10 days creates urgency. Adding late fees for overdue payments can also discourage delays.

Build Trust Through Relationships

Clients are more likely to pay on time when they trust and value your relationship. Maintain open communication, deliver high-quality work, and show reliability in your interactions. Strong relationships foster mutual respect and timely payments.

Send Reminders Before the Due Date

A gentle reminder 3-5 days before the payment due date helps clients prepare and avoid missing deadlines. These reminders can be automated or sent manually, ensuring the client is aware of the upcoming payment.

Request Upfront or Partial Payments

Requiring partial or upfront payments for larger projects reduces the risk of non-payment. For example, requesting 50% upfront ensures you have partial payment secured before beginning the work.

Bonus Tips for Getting Paid on Time

Here are some extra tips to ensure your payments arrive promptly:

- Build Strong Client Relationships: Positive relationships with clients increase trust and make them more likely to prioritize your payments.

- Set Payment Reminders in Advance: Sending reminders a week before the due date helps clients stay on track.

- Stay Organized: Keep detailed records of invoices, payment terms, and follow-up communications. This makes it easier to resolve disputes or track overdue payments.

Conclusion

Requesting payment from clients doesn’t have to be difficult. With clear communication and the right tools, you can simplify the process and avoid stress.

Using polite emails, timely follow-ups, or quick phone calls helps you get paid on time while maintaining positive client relationships. If any issues arise, address them calmly and professionally to show you’re organized and reliable.

To save time and streamline your workflow, tools like Agency Handy can automate reminders, track payments, and keep invoices organized. This makes it easier for you to focus on your work instead of chasing payments.

FAQs

What should I do if I accidentally send an incorrect invoice?

If you send an incorrect invoice, inform the client immediately, apologize for the mistake, and issue a corrected invoice. Clearly highlight the changes to avoid confusion and ensure the revised invoice is processed smoothly.

Should I include late fees in every invoice?

Late fees are optional, but it’s good practice to include them in your payment terms. If you decide to charge late fees, make sure they’re mentioned in the contract or invoice terms before the project starts.

How can I follow up without sounding repetitive?

Vary the tone and content of your follow-up messages. For example, your first follow-up can be friendly, while later reminders can focus more on the urgency of the payment while still remaining professional.