Tired of Recurly’s bugs, rigid setup, or rising costs? You’re not alone. Many teams feel boxed in by its limitations.

We looked for tools that fix what Recurly gets wrong: better automation, flexible billing logic, client-facing transparency, and real support.

This article reviews the top Recurly alternatives, based on real-world testing, not marketing claims.

Quick List of Recurly Alternatives

- Agency Handy: Automates recurring billing, client invoicing, and service-based workflows for agencies.

- Chargebee: Handles subscription lifecycles, billing automation, and revenue operations for SaaS businesses.

- Zoho Billing: Manages recurring invoices, metered billing, and payment collection within the Zoho ecosystem.

- Zuora: Supports complex pricing models, global billing rules, and enterprise-scale finance operations.

- Maxio: Combines subscription billing, revenue recognition, and SaaS analytics in a single finance platform.

Why Should You Consider a Recurly Alternative?

You’ve likely noticed recurring concerns regarding the performance if you’ve checked Recurly reviews or explored Recurly alternative Reddit threads. Here are the ones we found most concerning:

1. Persistent Software Bugs

Users often encounter recurring glitches that interfere with essential billing tasks. These bugs can break workflows and erode trust over time.

2. Slow Subscription Creation

Creating new subscriptions sometimes takes longer than expected. For teams managing high volumes, this sluggishness can seriously impact onboarding speed.

3. High Pricing

Recurly’s pricing structure can become steep as your needs scale. Many businesses find themselves paying more than the value received.

4. Poor Customer Support

When issues arise, getting help can be a frustrating experience. Delayed responses and limited solutions leave teams without the support they need.

Quick Comparison Table of Top Alternatives to Recurly

Let’s compare the software based on important subscription management features for service-based businesses:

| Tool | Client Portal | Global Payment Processing | Customizable Billing Cycles | Coupon Management | User Ratings |

| Agency Handy | ✅ | ✅ | ✅ | ✅ | 4.9 |

| Chargebee | ❌ | ✅ | ✅ | ✅ | 4.4 |

| Zoho Billing | ✅ | ✅ | ✅ | ✅ | 4.3 |

| Zuora | ❌ | ✅ | ✅ | ✅ | 3.9 |

| Maxio | ❌ | ✅ | ✅ | ✅ | 4.3 |

Top 5 Recurly Alternatives for Subscription Management

We tested 15 subscription management tools and shortlisted the top 5 Recurly competitors based on performance, features, and user experience. Here’s what we think:

1. Agency Handy

Agency Handy is built for teams juggling clients, services, and billing all at once.

What impressed me right away was how effortlessly it handles recurring invoices, custom billing cycles, and client communications.

From white-label client portals to fully customizable automated reminder schedules, it’s purpose-built for agencies.

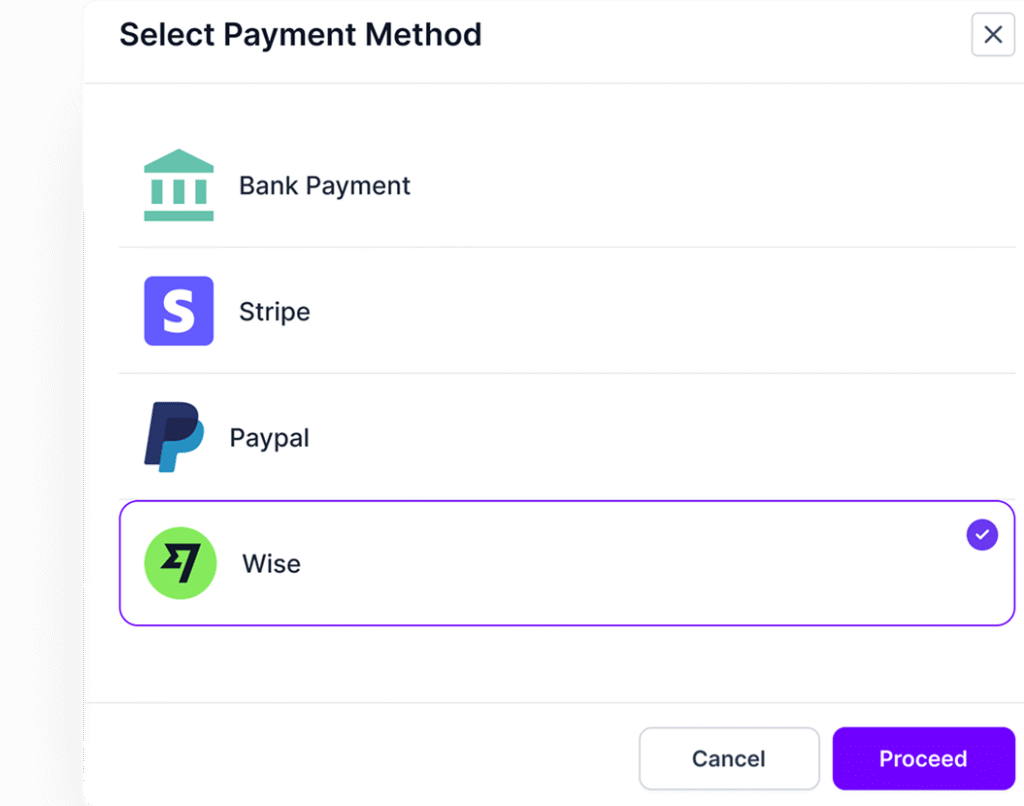

Payment support from PayPal, Stripe, Wise, and manual banking means you can bill customers anywhere in the world.

But what about the user experience? I tested so many tools to find the best alternatives, and let’s just say not all platforms are as smooth.

Recurly, for instance, left me chasing support tickets and waiting for subscriptions to load, things that should be instant. The learning curve was steep, and the bugs slowed us down quite a bit.

With Agency Handy, it’s different. It’s clean, responsive, and easy to customize. The pricing makes sense, too, no confusing tiers or surprise add-ons.

If you’re growing and need a billing platform that moves as fast as your business, Agency Handy isn’t just an alternative to Recurly. It’s a real upgrade.

Features of Agency Handy

Agency Handy is more than just a billing tool. From onboarding to payments, it brings everything into a customizable workspace. Here’s an in-depth look at the features:

Flexible Service Listings with Coupon Management

Showcase your services using multi-tier pricing—perfect for offering standard, premium, and trial options. Each listing can include FAQs to answer common client questions upfront.

Generate and apply discount codes instantly and manage who can access the coupons. Share your listings via direct links or embed them on your site for easy, self-serve checkout.

Visual Portfolio & Case Study Builder

Show off your best work through a clean, categorized portfolio interface. You can add images, testimonials, and case studies to build authority and convert more prospects into paying clients.

Custom Intake & Order Forms

Customize intake and order forms with checklists, file uploads, dropdowns, and more. Use these forms before or after purchase, depending on your process.

You can also upsell add-ons directly within the order form, streamlining both onboarding and revenue generation.

Visual Lead Tracking

Use a drag-and-drop pipeline to follow leads through every stage of the sales journey. Keep full records of each contact, emails, locations, history, and assign team members to manage follow-ups effectively.

Centralized Client Profiles

Maintain all client-related info, contact details, order history, support interactions, and invoices in one easy-to-access profile. Clients get a branded, white-label portal to check progress and communicate with your team.

Task and Project Management

When a client places an order, tasks are automatically generated and assigned. Set deadlines, prioritize work, and monitor progress through a visual Kanban board. Built-in time tracking helps keep billing accurate and your team accountable.

Seamless Client Collaboration

Assign roles and manage feedback directly in the portal. Clients and team members can leave comments on shared files, review versions, and approve work. The file feedback tool lets you leave annotations on images, PDFs, and videos. Track version history and activity log to ensure no work is lost.

Role-Based Team Management

Control who sees what with detailed permission settings. Define roles like Super Admin, Manager, or Assignee to ensure everyone has the right access level without compromising data security.

Recurring Billing & Multi-Gateway Payments

Generate and send invoices automatically for both one-time and recurring billing. Accept payments via Stripe, PayPal, or Wise, and automate reminders to ensure timely payments with less manual chasing.

Ticketing & Support System

Handle client issues through an integrated ticketing system. Each ticket logs priority, client details, and status, so nothing slips through the cracks. Export data or review it from a centralized view to speed up resolution times.

Performance Insights Dashboard

Track agency metrics like revenue, client count, order flow, and team activity through a clean dashboard. Stay up to date with ticket and order summaries to make fast, data-backed decisions.

White-Labeled Customizable Workspace

Make the platform truly yours by setting a custom logo, colors, favicon, business name, timezone, and contact details. Everything your clients see reflects your brand, keeping things cohesive and professional.

Pros of Agency Handy

- Custom billing cycles for recurring invoices

- Branded client portals with white labeling

- File feedback with in-app annotations

- Supports multi-currency and multilingual billing

- Automated reminders for payment and renewals

- Revenue dashboard with subscription metrics visibility

Agency Handy Pricing

Agency Handy offers three-tiered pricing plans for businesses of all sizes:

What Users Say About Agency Handy?

- Rating on G2: 4.9 out of 5

- Rating on Product Hunt: 5 out of 5

- Rating on Trustpilot: 3.8 out of 5

Why Should You Choose Agency Handy Over Recurly?

See how Agency Handy solves the biggest Recurly pain points with smarter, agency-focused solutions.

| Limitations of Recurly | How Agency Handy Solves It |

| Frequent billing bugs | Provides a stable, reliable billing system built for agencies |

| Slow subscription setup | Let’s you create and activate subscriptions in seconds |

| Basic reminder controls | Offers fully customizable reminder schedules and email templates |

| Steep scaling costs | Delivers transparent, scalable pricing with no hidden fees |

| No client portal | Includes fully white-labeled portals for easy client access |

| No order tracking | Clients track orders, payments, and feedback in real time |

2. Chargebee

Chargebee strikes a balance between flexibility and accessibility. It’s built for SaaS and subscription-first businesses that want fast iteration without worrying about backend billing logic.

What really works in Chargebee’s favor is its depth of automation. You can automate invoicing, proration, tax handling, and even trial-to-paid transitions with minimal setup.

And if you’re into integrations, it plugs into CRMs, accounting tools, and analytics platforms right out of the box.

Still, the interface can feel a little dated, and advanced configurations sometimes send you deep into the docs. It’s not the most modern UI, but it’s stable, mature, and well-supported.

If you’re after reliable, scalable billing without going full enterprise, Chargebee is one of the best mid-market options around.

Key Features of Chargebee

Chargebee is an amazing invoicing software that combines subscription automation with flexible pricing tools and deep analytics.

- Subscription Lifecycle Management: Create, pause, upgrade, or cancel subscriptions anytime. Automates customer communications across all stages for smoother experiences.

- Flexible Product Catalog: Supports multiple plans, add-ons, and currencies per product. Helps keep global pricing structured and scalable.

- Automated Invoicing & Tax Compliance: Generates recurring invoices with region-specific tax rules. Works across multiple currencies with minimal setup.

- Metered Billing Support: Bill users based on feature or usage metrics. Ideal for hybrid models and usage-driven pricing structures.

- Custom Checkout & Self-Service Portal: Offers branded, secure checkout pages and client portals. Let’s customers manage plans, billing, and payments independently.

- Advanced Dunning Management: Custom retry logic and reminder emails for failed payments. Increases revenue retention with minimal manual work.

- Analytics & Revenue Insights: Delivers clear reports on churn, MRR, and revenue. Helps finance and ops teams stay data-informed.

- Third-Party Integrations: Connects with CRMs, payment gateways, and accounting tools. Keeps data flowing across your stack without friction.

Pros of Chargebee

- Customizable checkout pages enhance user experience

- API facilitates developer-friendly integrations

- Supports multi-currency and global taxation

- Comprehensive analytics for revenue insights

- Efficient dunning management minimizes payment failures

Cons of Chargebee

- Limited installment options at the product level

- Complex setup for advanced revenue recognition

Chargebee Pricing

Chargebee offers multiple pricing tiers based on your business stage and billing complexity:

- Starter: $0/month – Free until you reach $250K in cumulative billing, then 0.75% on billing.

- Performance (Billing): $599/month – For up to $100K/month billing

- Performance (Revenue Recognition): Custom pricing

- Performance (Retention): Starts at $250/month

- Enterprise: Custom pricing

What Do People Say About Chargebee?

- Rating on G2: 4.4 out of 5

- Rating on Capterra: 4.3 out of 5

3. Zoho Billing

Zoho Billing stood out to me for its range. This platform doesn’t just do subscriptions. It also handles usage-based, flat-rate, and even project-based billing all in one place.

That kind of flexibility is rare without getting tangled in custom setups. I also liked how configurable the dunning process is. You can tweak retry intervals, message timing, and recovery steps with almost surgical precision.

The analytics were a step up, too. Unlike Recurly’s surface-level reports, Zoho gives you deep, actionable insights into revenue, churn, and billing health.

Revenue recognition is fully automated and audit-ready, which removes a big layer of financial guesswork.

Still, I did run into a few limitations. The UI takes a little time to get used to, and the setup feels more enterprise-focused.

But if you’re managing complex billing scenarios, this platform checks a lot of boxes. It’s flexible, powerful, and surprisingly affordable.

Key Features of Zoho Billing

Zoho Billing stands out with flexible billing tools, automation, and real-time insights, ideal for teams outgrowing Recurly.

- Advanced Dunning Management: Recover failed payments with custom retry schedules and follow-ups. Control timing and messaging to reduce churn without manual effort.

- Flexible Pricing Models: Supports flat-rate, usage-based, tiered, and volume billing. Easily align pricing with your business model—no custom code needed.

- Subscription Lifecycle Management: Handles upgrades, downgrades, renewals, and cancellations smoothly. Built to support complex scenarios without disrupting workflows.

- Automated Invoicing & Tax Compliance: Auto-generates invoices with built-in tax handling. Multi-currency support makes global billing easier and compliant.

- Metered Billing Support: Tracks real-time usage and turns it into accurate billing. Ideal for SaaS or services with variable consumption.

- Custom Payment Pages: Branded, PCI-compliant pages support multiple payment options. A smoother checkout helps boost conversion rates.

- Integrated Expense Management: Track expenses and convert them to invoices with ease. Includes receipt uploads and mileage tracking.

- Real-Time Analytics & Reporting: Offers 50+ detailed, customizable reports on revenue and churn. Use them to guide decisions and optimize billing strategy.

Pros of Zoho Billing

- Customizable dunning with retry rule control

- Supports tiered, volume, and usage pricing

- Lifecycle automation for subscription changes

- Auto-generates compliant multi-currency invoices

- Tracks and bills real-time usage data

Cons of Zoho Billing

- Fewer native integrations beyond Zoho apps

- The interface sometimes feels visually overloaded

Zoho Billing Pricing

Zoho Billing offers 3 pricing plans fit for one-time, recurring payment, and enterprise billing needs.

- Standard: $50/month or $39/month (billed annually)

- Premium: $100/month or $79/month (billed annually)

- Custom: Custom pricing

What Do People Say About Zoho Billing?

- Rating on G2: 4.3 out of 5

- Rating on Capterra: 4.5 out of 5

4. Zuora

Zuora is built for complexity—and it shows. If your business runs on hybrid models, global payments, or multilayered pricing, Zuora gives you the control to orchestrate it.

I found its strength in handling enterprise-grade use cases. For example: billing multiple entities across currencies, automating revenue recognition, and structuring plans that go beyond the basics.

But that power comes with a learning curve. It’s not a plug-and-play tool, and getting everything configured right takes time and technical muscle. The dashboard feels more ERP than SaaS, and it’s designed for large teams with dedicated billing ops.

Still, once you’re in the ecosystem, Zuora delivers. Its integrations, compliance support, and billing precision are top-tier.

Key Features of Zuora

Zuora is built for a high-complexity billing environment and deep financial controls for enterprise-grade businesses. Here are its standout features:

- Complex Subscription Handling: Supports upgrades, downgrades, pauses, and renewals. Built for high-volume and multi-product billing logic.

- Multi-Entity & Global Support: Manages billing across regions, currencies, and tax systems. Ideal for multinational and multi-brand organizations.

- Automated Revenue Recognition: Complies with ASC 606 and IFRS 15. Tracks and defers revenue across complex deal structures automatically.

- Usage-Based and Hybrid Billing: Handles flat-rate, metered, and hybrid pricing models. Perfect for SaaS, IoT, and media companies.

- Branded Self-Service Portals: Let customers manage subscriptions, client invoices, and payments. Customizable for different regions or business units.

- Advanced Dunning & Retry Logic: Automates retries and custom follow-ups for failed payments. Reduces involuntary churn with precision.

- Finance-Grade Reporting: Offers audit-ready financial insights and granular billing data. Supports forecasting and board-level reporting.

- Strong Ecosystem Integrations: Works seamlessly with ERPs, CRMs, tax engines, and analytics platforms. Keeps enterprise systems in sync.

Pros of Zuora

- Automates revenue recognition processes effectively

- Handles multi-currency and global taxation

- Facilitates advanced dunning and collections management

- Delivers advanced analytics and reporting tools

- Enables customized workflows and automation

Cons of Zuora

- Customization requires significant technical expertise

- Overwhelming user interface

Zuora Pricing

Zuora doesn’t publish fixed pricing on its website. Plans are fully customized based on your billing volume, business model complexity, and required features.

What Do People Say About Zuora?

- Rating on G2: 3.9 out of 5

- Rating on Capterra: 3.9 out of 5

5. Maxio

Maxio feels like it was built for SaaS finance teams who live in spreadsheets and care deeply about revenue metrics.

I found how it brings subscription billing and revenue recognition under one roof impressive.

You don’t just automate invoices—you track MRR, ARR, deferred revenue, and everything in between with serious accuracy.

What Maxio does well is insight. The analytic tools go beyond surface-level dashboards and dig into cohort behavior, retention trends, and segmented performance. It’s the kind of tool you use when you want billing to talk directly to your strategy.

That said, it’s not the most intuitive platform for non-finance folks. Setup takes some accounting knowledge, and the interface prioritizes depth over ease.

But if you’re scaling fast and want clean data for board decks and forecasting calls, Maxio makes that a whole lot easier.

Key Features of Maxio

Maxio brings together subscription billing, SaaS metrics, and revenue recognition, ideal for finance teams who need clarity and control.

- Subscription Management Automation: Handles renewals, plan changes, and proration. Built for fast-moving SaaS with complex contract terms.

- Revenue Recognition Engine: Automates compliance with ASC 606 and IFRS 15. Recognizes revenue as it’s earned, not just when billed.

- Usage-Based and Tiered Billing: Supports usage metrics, tiered pricing, and overages. Great for SaaS and services with variable billing needs.

- Smart Invoicing & Collections: Generates invoices with custom rules and sends dunning emails. Tracks AR aging to improve collection efficiency.

- Customer Self-Service Portal: Let customers update cards, download invoices, and manage subscriptions. Reduces support workload significantly.

- SaaS Metrics & Forecasting: Tracks MRR, churn, CAC, LTV, and cohorts. Offers prebuilt dashboards and custom financial reporting.

- Advanced Deal Management: Configures billing terms for sales-led contracts. Aligns finance with sales through approval workflows.

- Integration-Friendly Architecture: Syncs with CRMs, ERPs, and payment gateways. Keeps finance, ops, and product teams aligned.

Pros of Maxio

- Comprehensive SaaS metrics and analytics

- Seamless integrations with CRMs and ERPs

- Flexible invoicing with customizable templates

- Revenue recognition meets ASC 606 & IFRS 15 compliance

- Detailed reporting for financial insights

Cons of Maxio

- Occasional system bugs and glitches

Maxio Pricing

Maxio offers three pricing tiers, Build, Grow, and Scale, designed to support SaaS companies.

- Build: Free for 90 days

- Grow: $599/month (for up to $100K monthly billing)

- Scale: Custom pricing

What Do People Say About Maxio?

- Rating on G2: 4.3 out of 5

- Rating on Capterra: 4.3 out of 5

Final Words

If Recurly is slowing you down or limiting your billing flexibility, it might be time to switch. We tested each alternative on real performance: billing automation, pricing control, client experience, and support.

We found strong contenders for different needs. Whether you’re scaling fast, managing hybrid models, these Recurly alternatives are built to keep you moving forward.

FAQs

How easy is it to migrate from Recurly?

Most providers, including Chargebee and Zoho Billing, offer migration assistance. Agency Handy and Maxio provide onboarding support as well, but the complexity depends on your billing volume and contract structure.

Which alternative works best for agencies?

Agency Handy is purpose-built for service-based agencies. It combines billing, invoicing, task management, and client collaboration in one platform—something general-purpose tools like Recurly don’t offer.

Which one supports usage-based or metered billing best?

Zuora and Chargebee are the most advanced here. Maxio also does a great job for SaaS-style usage billing. Agency Handy supports tiered billing but not metered tracking yet.

Is there a truly free Recurly alternative?

Yes, Zoho Billing and Chargebee both offer limited free plans. Maxio’s “Build” tier is also free for 90 days, perfect for startups in early validation.